The company’s income statement will show how good the revenue and earnings are. Let’s take a hypothetical example of a company making extremely good sales at a very good margin, never collecting any payment for its sales. So one may ask – how is this useful for me? As an investor, a cash flow statement is an extremely important tool to diagnose the financial health of a company.

#Cash flow or cashflow for free

A formula for Free Cash Flow to the Firm.There are a few things you can do to manage the length of your cash flow cycle and generate the highest amount of positive cash in each cycle.

The higher your profit margin, the more cash you will generate. Ideally, each cash flow cycle will generate some profit and therefore will generate free cash. The longer your cash flow cycle, the longer you have money tied up in the business that you can’t use for other purposes. Your cash flow cycle length is essentially the amount of time from the start of production, when you begin the service or purchase materials, to when you sell the service or product and collect your cash. For instance, you can better determine when to make a major purchase or when it’s time to seek additional capital from investors. Understanding and analyzing these monetary cycles can lead to wiser decisions. Reviewing monthly cash flow statements helps you recognize cyclical patterns. Resources such as this can help you gain a better grasp of the importance of cash flow and how cash management can drive a business forward.Įvery business has a natural cash flow cycle. To learn more about cash flow, read the e-book, Beginner’s Guide to Cash Flow online.

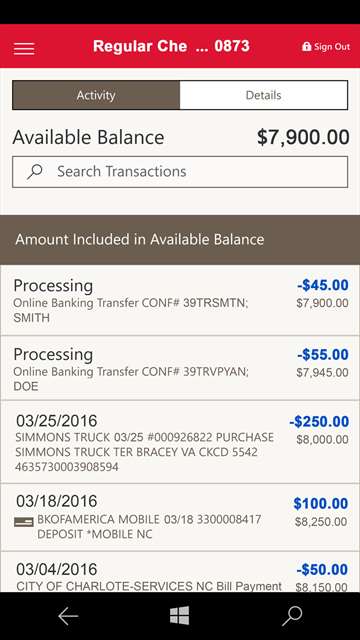

Lack of cash flow is one of the main reasons for small businesses to fail. Just like the names suggest, it is a positive thing when you have money circulating through the company, a negative circumstance when it does not. In contrast, negative cash flow is the lack of such liquid assets, meaning a company is in financial trouble and cannot pay for the operating activities and expenses required to run properly. Positive cash-flow means a company is increasing its liquid assets, allowing them to cover expenses, reinvest in the business, pay off shareholders while also possessing a cash reserve to offset future financial issues that might arise. When it comes to measuring cash flow, businesses should seek to have a positive cash flow over a negative cash flow. Therefore, Rebecca has a positive cash flow this month, as she made $7060, spent $4500, leaving her with $2560 of net income, or cash on hand. Her expenses covering these operating activities amounted to $4500. She must pay for these expenses, creating an outflow of cash from the company. These sales are recorded as revenue and refer to the cash flowing into a company.īut Rebecca also has to pay operating costs for her business, purchasing more art supplies for her inventory, paying rent for her storefront, and paying her other employees. In one month she recorded the sale of 170 paintbrushes, 89 canvases, and 226 tubes of paint, making a total of $7060. Money flows out of the business when it needs to pay for expenses, such as rent, payroll, and inventory purchase orders.įor example, Rebecca runs an art supply store and wants to get a handle on the money passing through her business. Cash is coming into the business’s accounts when they sell their goods and services to customers, generating revenue. The inflow and outflow of cash spans all areas of the business.

0 kommentar(er)

0 kommentar(er)